As global economic uncertainties mount, investors are keeping a close eye on the SBI share price and other quality stocks. A new report by SBI Funds Management recommends focusing on businesses with strong fundamentals and long-term growth potential, especially during periods of macroeconomic instability.

Global Uncertainty and Its Impact on SBI Share Price

The recent return of aggressive US trade policies, particularly under Trump 2.0, has sparked fresh concerns in global financial markets. Sharp tariff hikes and inflation risks have led to volatile stock movements worldwide. India hasn’t been spared — reciprocal tariffs of up to 27% have been introduced across several sectors, increasing market jitters.

Despite these headwinds, the SBI report highlights a silver lining for long-term investors. It suggests that now may be a favorable time to invest in quality stocks like SBI, thanks to market corrections that have brought valuations closer to historical averages. The SBI share price, along with other blue-chip stocks, could benefit as investor sentiment stabilizes.

RBI’s Liquidity Measures and Market Sentiment

India’s central bank, the RBI, has taken proactive steps to manage liquidity. Since December 2024, over Rs 8.9 lakh crore has been pumped into the financial system through open market operations and other tools. These measures have contributed to easing market interest rates and improving monetary policy transmission.

The SBI share price and overall market sentiment have shown signs of resilience. According to the report, the neutral levels of investor sentiment and improving macro indicators make current market conditions more favorable for disciplined, long-term investment strategies.

Rupee Recovery and the Role of RBI

Another positive factor is the partial recovery of the Indian rupee, which had earlier dipped during the fiscal year. Forex market dynamics, capital flows, and RBI interventions will continue to play a key role in shaping the economic environment, which directly impacts stocks like SBI.

The SBI report anticipates further rate cuts by the RBI in the upcoming monetary policy review. However, it cautions that the central bank may adopt a neutral stance given the ongoing global uncertainties.

Investment Strategy: Focus on Quality, Not Just the SBI Share Price

While tracking the SBI share price is crucial for investors, the report emphasizes the importance of investing in businesses with robust models, consistent earnings, and strong cash flows. “Investors should prioritize companies with clear earnings visibility and sustainable cash generation, especially in times of economic turbulence,” the report says.

For those interested in debt markets, SBI Funds recommends short-term bond funds and credit-oriented strategies, which could offer solid returns in the current low-interest-rate environment. Additionally, hybrid investment products are suggested as a stable option to weather equity market volatility.

Conclusion: Long-Term Optimism for SBI Share Price and Market Health

Despite global challenges, the outlook for the SBI share price remains positive in the long term, supported by strong domestic fundamentals and policy support. As India continues to manage liquidity and inflation effectively, investors focusing on quality stocks like SBI may be well-positioned to achieve steady gains.

📌 Frequently Asked Questions (FAQ)

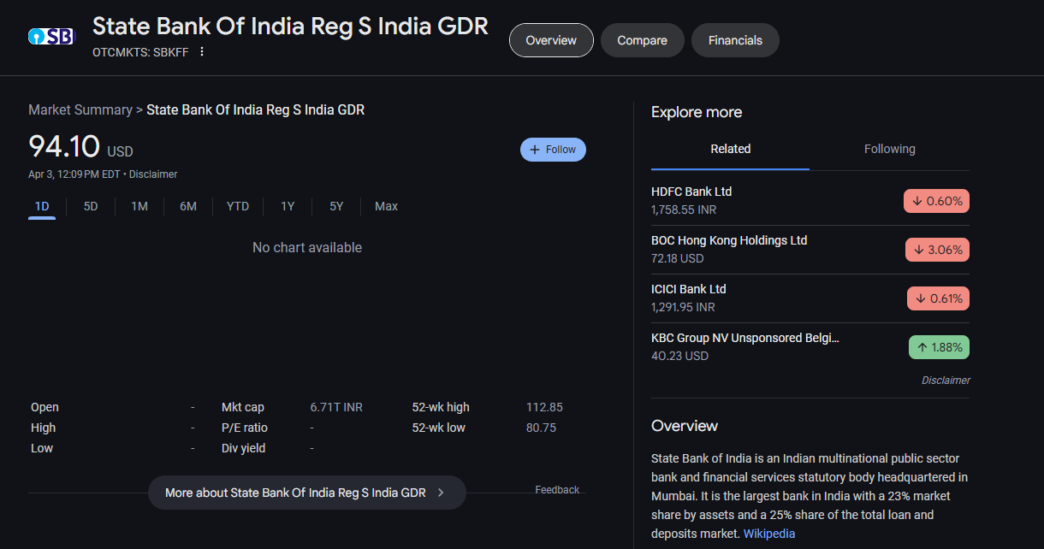

1. What is the current SBI share price?

The SBI share price changes daily based on market movements. To get the most accurate and real-time data, it’s best to check the official NSE (National Stock Exchange) or BSE (Bombay Stock Exchange) websites.

2. Is SBI a good stock to buy in 2025?

Yes, many analysts and reports, including SBI Funds Management, view SBI as a strong long-term investment due to its consistent earnings, strong fundamentals, and solid market position in India’s banking sector.

3. How does RBI policy affect the SBI share price?

RBI’s policies directly influence interest rates and banking liquidity. When the RBI lowers interest rates or injects liquidity, it usually supports bank stocks like SBI by improving lending conditions and margins.

4. What are the risks of investing in SBI shares now?

While SBI has strong fundamentals, risks include global economic uncertainty, tariff-related tensions, and domestic inflation pressures. However, long-term investors may find opportunities during market corrections.

5. Should I invest in SBI during global market volatility?

Experts recommend focusing on quality stocks like SBI during uncertain times. Its strong business model and consistent cash flows make it a relatively safer bet for long-term portfolios.

6. Can SBI share price grow significantly in the next few years?

If India’s economy continues to grow steadily and banking reforms support credit expansion, SBI share price has the potential to deliver strong returns, especially if macroeconomic conditions stabilize.