In April, Bangladesh experienced a dip in exports, marking the first decline in four months. This downturn was primarily attributed to a slowdown in garment shipments, along with a decrease in other major product exports, dealing a setback to an economy striving to recover from ongoing crises.

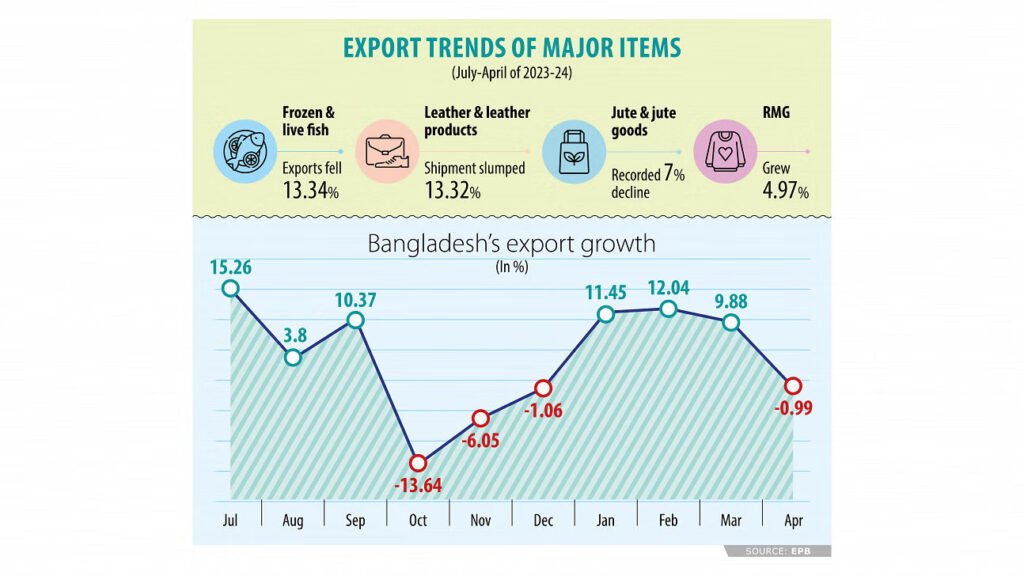

According to data released by the Export Promotion Bureau (EPB), the country’s exports totaled $3.91 billion last month, down by 0.99 percent compared to $3.95 billion from the previous year. These figures also represented the lowest export earnings in six months. However, from July to April of the current financial year, exports increased by 3.93 percent year-on-year to reach $47.47 billion.

The slump in exports, which serve as Bangladesh’s primary source of foreign currency, comes at a critical time as the economy grapples with a persistent dollar shortage and a widening deficit in the financial account, a key element of the balance of payments reflecting the country’s international transactions.

The export of ready-made garments, constituting approximately 85 percent of total export receipts, experienced a modest growth of 4.97 percent year-on-year, reaching $40.49 billion in the first ten months of the 2023-24 fiscal year, driven by increased demand for knitwear. While knitwear sales surged by 9.11 percent to $22.87 billion, exports of woven garments remained nearly stagnant, growing by only 0.03 percent to $17.61 billion.

Shams Mahmud, managing director of Shasha Denims Ltd, a prominent garment exporter, attributed the decline in exports to chronic gas shortages. He noted, “We are not receiving sufficient gas supply, resulting in reduced orders to maintain shipment lead times.” Industries have long complained about inadequate energy supply due to lower domestic gas generation, exacerbated by the government’s limited capacity stemming from dwindling foreign currency reserves.

Mahmud also cited a global decline in apparel demand as a contributing factor to reduced exports, compounded by delays in goods release at ports, leading to increased lead times. Additionally, he mentioned a growing trend of nearshoring among importing countries, driven by rising labor costs elsewhere.

Other key sectors such as leather and leather products, jute and jute goods, home textiles, and frozen and live fish also experienced declines in exports, as per EPB data. For instance, leather and leather product exports, the second-largest after RMG, fell by 13.3 percent year-on-year to $872 million from July to April of the current fiscal year, with leather footwear exports plummeting by 26 percent to $430 million.

Arifur Rahman Chowdhury, general manager of ABC Footwear Industries Ltd, lamented the sector’s challenges in importing raw materials under the bonded warehouse facility, alleging difficulties with customs offices and inadequate banking support.

In the jute sector, rising raw jute prices and falling yarn prices in the global market, coupled with subdued demand for carpets in the US, have posed challenges for exporters. Helal Ahmed, chief operating officer of Janata Jute Mills and Sadat Jute Industries Ltd, highlighted the economic struggles of key importing countries like Turkey, alongside rising domestic borrowing costs, further exacerbating the situation for businesses.

With the central bank gradually tightening the money supply, the interest rates on loans have surged, leading to increased financial burdens on businesses. For example, the weighted average interest rate on advances exceeded 13 percent in March this year, up from 7.24 percent in January of the previous year.