Are you struggling to get a merchant account for your business just because you’ve been labeled as “high-risk”? You’re not alone—and you’re not out of options either.

Many businesses across the U.S. face this challenge every day. But the good news is, there are specialized companies out there that work specifically with high-risk businesses—and one of the most trusted names in the industry is HighRiskPay.com.

In this in-depth review, we’ll walk you through everything you need to know about getting a high risk merchant account at Highriskpay.com, including what makes a business high-risk, how to qualify, and why HighRiskPay.com could be the solution you’ve been looking for.

🔍 What is a High-Risk Merchant Account?

A high-risk merchant account is a type of payment processing account designed for businesses that traditional banks consider risky. These accounts allow you to accept credit card and debit card payments, but they typically come with higher fees, stricter terms, and more thorough approval processes.

Why? Because the risk of chargebacks, fraud, or financial instability is higher in certain industries.

But don’t let the label scare you—it just means your business needs a processor that understands your needs and has systems in place to manage the risk.

🚨 Why Is a Business Considered High-Risk?

Banks and payment processors assess a number of factors before approving a merchant account. You might be flagged as high-risk due to:

-

High monthly sales volume (e.g., over $20,000/month)

-

Large average transaction size (e.g., $5,000 or more)

-

Accepting international payments

-

Being a startup or having no processing history

-

Operating in a high-risk industry like CBD, adult, travel, or subscription services

-

Low personal or business credit score

-

Frequent chargebacks or returns

Even if your business is thriving, these factors can lead to rejection by traditional processors like PayPal, Stripe, or Square.

⚠️ Common Industries Labeled as High-Risk

Certain industries are almost always considered high-risk, including:

-

Adult Entertainment

-

CBD and Hemp Products

-

Gambling and Sports Betting

-

Travel Agencies, Cruises & Airlines

-

Subscription-Based Businesses

-

Online Dating Platforms

-

Firearms & Ammunition

-

eCommerce & Dropshipping

-

Electronics and Furniture Retail

-

Debt Collection

-

Nutraceuticals & Supplements

-

MLM (Multi-Level Marketing)

-

Startups with no credit history

If you operate in any of these sectors, you’ll need a provider that specializes in high risk merchant accounts, like HighRiskPay.com.

🛠️ How to Choose the Right High-Risk Payment Processor

Choosing the right provider can be the difference between financial stability and payment processing headaches. Here are some quick tips:

1. Know Your Business Risk Level

Assess where your business stands in terms of volume, industry, chargebacks, and credit history.

2. Search for Specialized High-Risk Providers

Don’t waste time applying to traditional processors. Look for companies that work exclusively with high-risk clients, like HighRiskPay.com.

3. Compare the Essentials

-

Approval speed

-

Processing fees

-

Rolling reserves

-

Industries supported

-

Contract terms

-

Customer support

-

Integration with your current tools or website

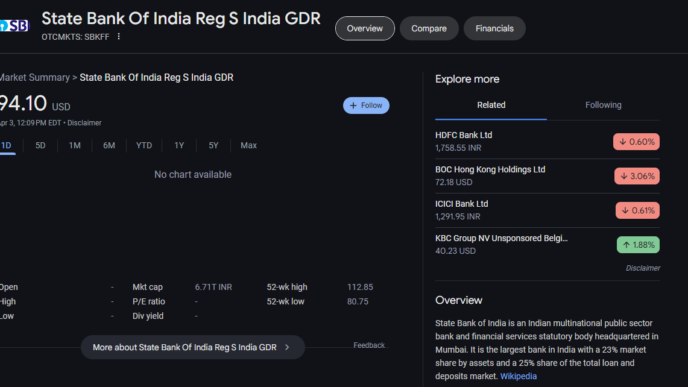

📊 Regular Merchant Account vs. High-Risk Merchant Account

| Feature | Regular Merchant Account | High-Risk Merchant Account |

|---|---|---|

| Risk Level | Low | High |

| Approval Time | Fast, minimal screening | Longer, strict underwriting |

| Fees | Lower | Higher |

| Chargeback Tolerance | Low | Higher, but monitored |

| Rolling Reserves | Rare | Common |

| Contract Terms | Flexible | Long-term & strict |

| Support for Niche Industries | Limited | Broad, high-risk sectors |

💡 Tips to Get Approved for a High-Risk Merchant Account

-

Maintain a strong bank balance to show stability.

-

Reduce chargebacks with clear policies and good customer service.

-

Be transparent during the application—honesty builds trust.

-

Keep documents ready, such as:

-

Last 6 months of bank statements

-

Business license

-

Processing history (if any)

-

Tax ID and personal ID

-

-

Follow your provider’s guidelines carefully to avoid account termination.

🏆 About HighRiskPay.com

HighRiskPay.com is a U.S.-based payment gateway and merchant account provider that’s been serving high-risk businesses since 1997. Known for its high approval rates and lightning-fast onboarding, it’s trusted by thousands of businesses that struggle to find traditional processing solutions.

Whether you’re a startup or running a full-scale operation with bad credit, HighRiskPay.com is built to help you accept payments securely and efficiently.

💼 Services Offered by HighRiskPay.com

-

✅ High-Risk ACH Processing

-

✅ Credit Card Processing (even with poor credit)

-

✅ Free Chargeback Management

-

✅ Advanced Fraud & Risk Detection

-

✅ 24/7 Customer Support

-

✅ Next-Day Funding

They also offer customized plans depending on your business type and volume, with zero application fees and no contract obligations.

🔥 Top Reasons to Choose HighRiskPay.com

Here’s what makes HighRiskPay.com a standout choice:

-

✅ 99% Approval Rate

-

✅ No Application Fee

-

✅ No Long-Term Contract

-

✅ Fast 24-Hour Approval

-

✅ Next-Day Fund Settlement

-

✅ Supports Low & Bad Credit Merchants

-

✅ Full Chargeback & Fraud Protection

📋 Industries Served by HighRiskPay.com

HighRiskPay.com proudly supports a wide range of industries often rejected by other processors, including:

-

Adult Industry

-

Firearm Sales

-

Startups

-

CBD and Hemp

-

Online Dating

-

Debt Collection

-

Travel & Tickets

-

Ecommerce

-

MLM Businesses

-

Tech Support

-

Online Pharmacies

-

Nonprofits

-

Sports Betting

-

Subscription Services

-

Nutraceuticals

-

Dropshipping

-

Credit Repair

-

High-Volume Businesses

No matter how niche your business, there’s a good chance HighRiskPay.com can work with you.

✅ Final Thoughts

If you’ve been denied a merchant account—or fear you might be—don’t let it hold your business back. A high risk merchant account at Highriskpay.com could be exactly what you need to grow your sales, reduce stress, and gain financial stability.

With their low fees, fast approval, and experience across dozens of high-risk industries, they’re one of the best in the game for U.S. businesses facing payment processing challenges.

❓ Frequently Asked Questions (FAQs)

What type of business is considered high-risk?

Businesses in sectors like adult entertainment, CBD, gaming, travel, firearms, dating, and e-commerce are usually flagged as high-risk due to chargebacks, legal issues, or regulatory complexities.

How can I tell if my business is high-risk?

If you face rejections from standard processors, deal in high-ticket items, or get frequent chargebacks, you’re likely high-risk. You can also consult with HighRiskPay.com directly to assess your risk level.

How do I open a high-risk merchant account?

Apply through a high-risk processor like HighRiskPay.com. Provide full business documentation, be honest about your volume and history, and follow all onboarding steps closely.

How much does a high-risk merchant account cost?

Costs vary but typically include higher transaction fees (3-5%), monthly charges, and possibly a rolling reserve. HighRiskPay.com offers competitive pricing with no application fee.

What documents do I need?

Usually:

-

Business license

-

Bank statements (3–6 months)

-

Tax ID (EIN)

-

Government-issued ID

-

Processing history (if applicable)

📌 Disclaimer

This article is published by Forbes BD for informational and educational purposes only. We do not offer financial advice or endorse any specific investment platform, including highriskpay.com. All investment decisions should be made with careful research and consultation with licensed financial advisors. While we strive for accuracy, Forbes BD makes no guarantees regarding the reliability or performance of third-party platforms mentioned in this article.